Get This Report on Vancouver Tax Accounting Company

Wiki Article

Getting My Small Business Accountant Vancouver To Work

Table of ContentsGetting My Virtual Cfo In Vancouver To WorkThe Greatest Guide To Cfo Company VancouverOur Outsourced Cfo Services IdeasSee This Report on Vancouver Accounting Firm9 Simple Techniques For Virtual Cfo In VancouverWhat Does Virtual Cfo In Vancouver Do?

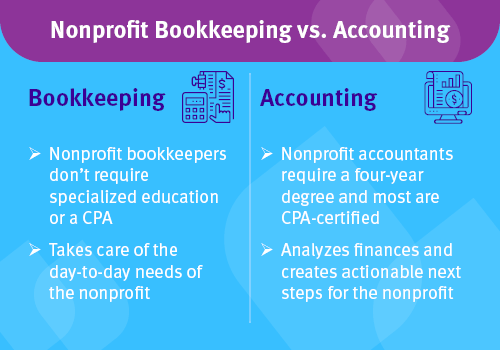

Below are some advantages to hiring an accountant over a bookkeeper: An accountant can provide you a detailed view of your organization's financial state, together with strategies and recommendations for making monetary decisions. On the other hand, accountants are just in charge of tape-recording monetary purchases. Accounting professionals are called for to complete more education, certifications and also job experience than bookkeepers.

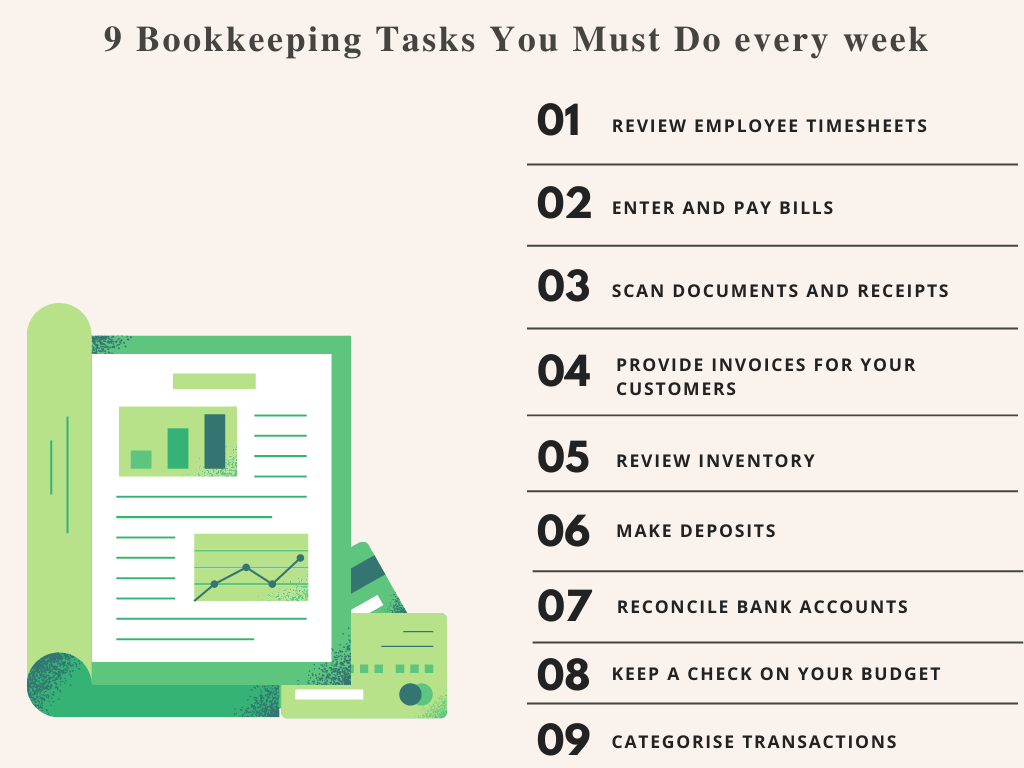

It can be difficult to assess the ideal time to work with a bookkeeping expert or bookkeeper or to identify if you need one whatsoever. While lots of small companies employ an accounting professional as a professional, you have numerous alternatives for taking care of monetary tasks. Some small business proprietors do their own accounting on software their accountant recommends or uses, giving it to the accounting professional on a regular, month-to-month or quarterly basis for activity.

It might take some history research to discover a suitable accountant due to the fact that, unlike accounting professionals, they are not needed to hold a specialist qualification. A strong endorsement from a trusted coworker or years of experience are necessary variables when hiring an accountant. Are you still not certain if you require to work with a person to assist with your publications? Right here are three instances that suggest it's time to work with a monetary expert: If your taxes have come to be too complicated to take care of by yourself, with numerous earnings streams, foreign financial investments, a number of deductions or other factors to consider, it's time to work with an accountant.

Cfo Company Vancouver - An Overview

For tiny companies, experienced money administration is a crucial element of survival and also growth, so it's smart to function with an economic professional from the beginning. If you favor to go it alone, think about starting out with accountancy software application as well as maintaining your publications meticulously approximately day. That method, need to you need to hire an expert down the line, they will useful content have visibility right into the total financial background of your business.

Some source interviews were performed for a previous version of this article.

Everything about Tax Accountant In Vancouver, Bc

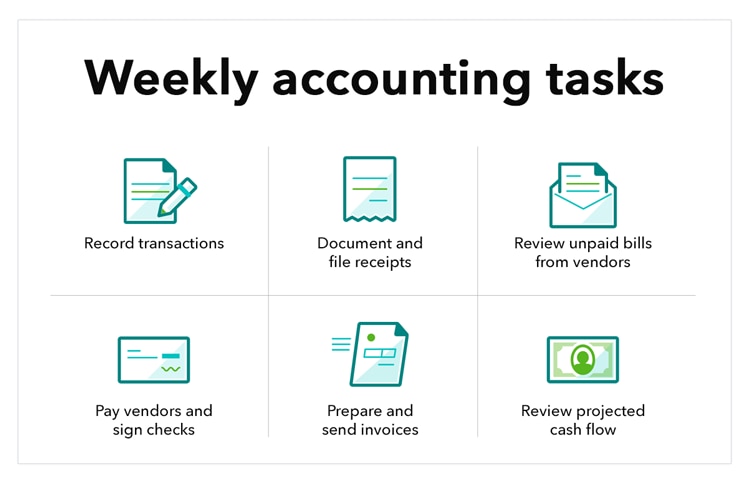

When it concerns the ins and also outs of taxes, accounting and finance, nonetheless, it never ever harms to have a skilled professional to count on for assistance. A growing variety of accountants are additionally caring for points such as cash circulation forecasts, invoicing and human resources. Ultimately, most of them are tackling CFO-like roles.Small organization proprietors can anticipate their accountants to help with: Picking business framework that's right for you is essential. It affects how much you pay in tax obligations, the documents you require click resources to submit as well as your individual responsibility. If you're looking to transform to a various organization framework, it can lead to tax consequences and various other problems.

Also business that are the very same size and industry pay extremely various amounts for bookkeeping. Prior to we enter buck figures, let's discuss the expenses that go into local business audit. Overhead costs are expenses that do not straight develop the accountant on video into a profit. Though these expenses do not exchange money, they are necessary for running your business.

The 45-Second Trick For Tax Consultant Vancouver

The typical expense of accountancy services for small business varies for each unique scenario. The average month-to-month accountancy charges for a little organization will climb as you add extra services and the jobs get harder.You can tape-record purchases and also process payroll utilizing on the internet software program. You enter quantities right into the software program, and also the program calculates total amounts for you. In some situations, pay-roll software application for accounting professionals permits your accounting professional to provide pay-roll processing for you at extremely little added expense. Software application options can be found in all shapes and also sizes.

More About Small Business Accounting Service In Vancouver

If you're a brand-new organization owner, do not fail to remember to element accounting prices into your budget. Management costs and also accounting professional charges aren't the only accounting expenditures.Your ability to lead workers, serve consumers, as well as make choices could suffer. Your time is also valuable as well as must be thought about when checking out accounting prices. The moment invested in accounting tasks does not produce revenue. The less time you spend on bookkeeping and taxes, the even more time you need to grow your company.

This is not intended as legal guidance; to find out more, please click below..

The Best Strategy To Use For Outsourced Cfo Services

Report this wiki page